Lenders carefully assess borrowers' credit history, income, vehicle value, and creditworthiness to determine title loan maximum terms. Regulations in specific locations like San Antonio influence term limits, with flexible payment plans making these loans more accessible. The evaluation process considers collateral and its market value, aligning loan terms with the borrower's financial profile and vehicle worth while mitigating risk for lenders.

In today’s competitive lending landscape, understanding how lenders determine title loan maximum terms is paramount for borrowers. This intricate process involves a multifaceted approach, driven by advanced risk assessment tools and technological innovations. Lenders consider factors such as creditworthiness, payment history, collateral value, and state regulations to set these terms. By leveraging data analytics, predictive modeling, and AI, they mitigate risks more effectively. Furthermore, digital transformation streamlines processes, while online platforms foster market competition. Future trends like blockchain and decentralized lending promise even greater efficiency in title loan maximum term determination.

- Understanding the Factors Influencing Title Loan Maximum Terms

- – Creditworthiness and Payment History

- – Type of Collateral and Its Value

Understanding the Factors Influencing Title Loan Maximum Terms

When it comes to understanding how lenders determine title loan maximum terms, several factors come into play. These include the borrower’s credit history, income level, and the value of their collateral—in this case, their vehicle. Lenders carefully assess these aspects to gauge the borrower’s ability to repay the loan promptly, ensuring both fairness and minimal risk.

Moreover, specific locations like San Antonio Loans often have unique regulations that influence maximum term limits. For instance, motorcycle title loans in San Antonio might offer shorter terms due to the specialized nature of the collateral, while traditional title loans could extend further based on state laws and lender policies. Payment plans also play a crucial role, as flexible options cater to borrowers’ needs, enhancing accessibility and manageability.

– Creditworthiness and Payment History

Lenders carefully assess an applicant’s creditworthiness and payment history when determining title loan maximum terms. This includes evaluating credit scores, outstanding debts, and past loan repayment behavior. Applicants with strong credit profiles and a proven track record of timely payments are more likely to qualify for longer loan terms and higher borrowing limits. Conversely, those with lower credit ratings or a history of missed payments may face shorter loan terms and lower maximum amounts.

Understanding one’s financial situation is crucial when seeking Houston title loans. Lenders need to gauge an applicant’s ability to repay the loan without causing significant financial strain. A solid payment history demonstrates responsible borrowing, which can lead to more favorable loan terms and increased financial assistance. On the other hand, a weak credit profile may result in shorter-term offers and lower borrowing capacities.

– Type of Collateral and Its Value

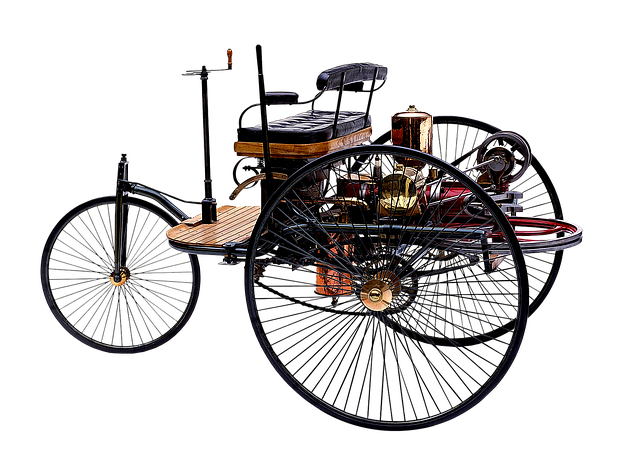

When lenders assess a borrower for a title loan maximum term, they closely examine the type of collateral offered and its current market value. The most common form of collateral in these loans is a vehicle, typically a car or truck. Lenders use the vehicle’s appraisal value to determine the maximum loan amount and, consequently, the repayment period. The higher the vehicle’s worth, the more generous the terms tend to be, offering borrowers a financial solution for short-term needs without requiring long-term debt obligations.

This evaluation process is crucial in ensuring both the lender and borrower are protected. For lenders, it mitigates risk by aligning loan amounts with the collateral’s value. For borrowers, it provides access to quick cash for unexpected expenses or debt consolidation, offering a viable alternative to traditional loans with potentially stringent terms. This approach allows individuals to leverage their assets as security, gaining financial flexibility while navigating challenging monetary situations.

Lenders carefully assess a borrower’s creditworthiness, payment history, and the value of their collateral to determine the maximum terms for title loans. By considering these factors, lenders ensure responsible lending practices while offering borrowers flexible options to meet their financial needs. Understanding these criteria is essential for individuals seeking title loans, allowing them to make informed decisions and access the funds they require efficiently.